Lower Middle-Market Private Equity Firm

Content:

Content:

Content:

Category:

Category:

Category:

New Deal Flow

New Deal Flow

New Deal Flow

Appointments

Appointments

Appointments

Days

Days

Days

Client Background

A lower middle-market private equity firm with a portfolio company in the B2B software space, seeking to execute a roll-up strategy.

The Challenge

The firm needed to find proprietary, off-market add-on acquisition targets to accelerate their portfolio company's growth. Inbound deal flow from bankers was scarce, competitive, and often did not fit their specific investment thesis.

The Solution & Results

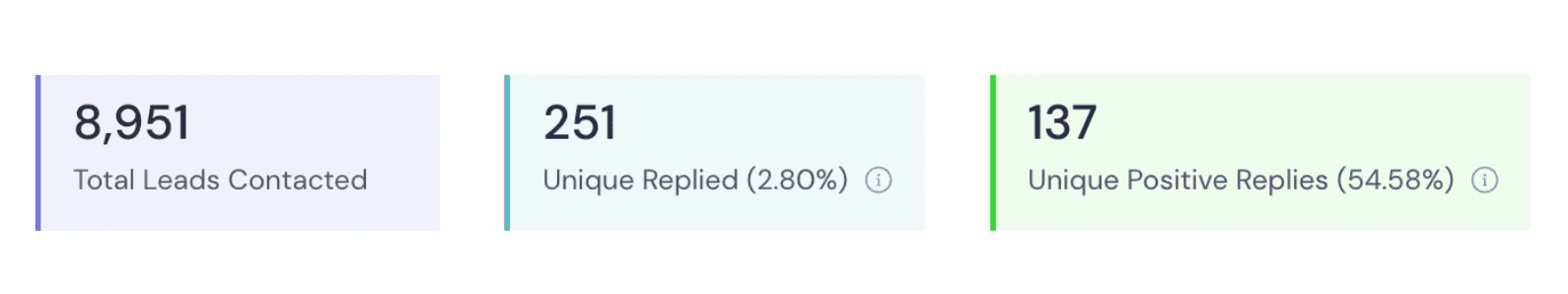

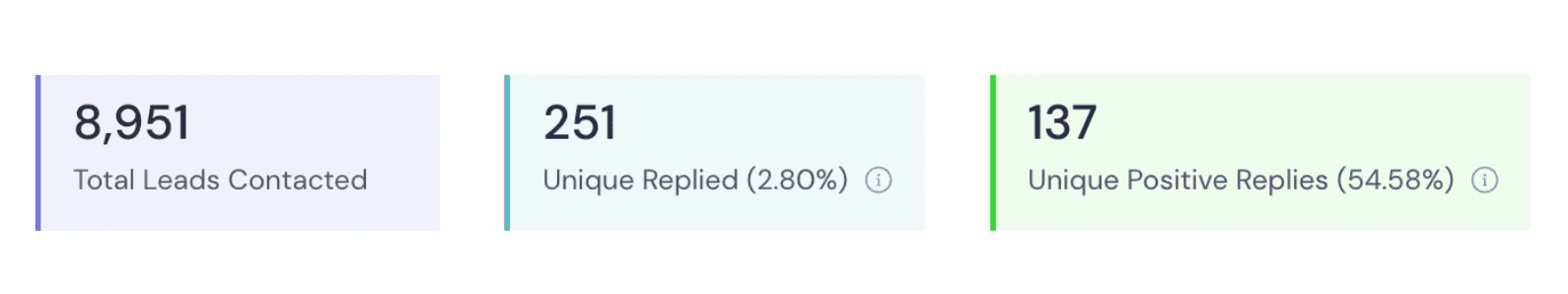

We deployed a systematic outreach campaign targeting founders and CEOs of smaller, complementary software companies that were not actively for sale. The messaging was positioned as a strategic partnership inquiry, leading to high engagement.

The program generated 137 initial conversations with founders, bypassing the traditional, auction-driven M&A process.

Within 60 days, this activity surfaced $3.2M in actionable, off-market acquisition opportunities that fit the firm's strategic criteria.

This established a repeatable, proprietary deal origination engine for the firm, allowing them to execute their add-on strategy with a pipeline of non-competitive opportunities.

Client Background

A lower middle-market private equity firm with a portfolio company in the B2B software space, seeking to execute a roll-up strategy.

The Challenge

The firm needed to find proprietary, off-market add-on acquisition targets to accelerate their portfolio company's growth. Inbound deal flow from bankers was scarce, competitive, and often did not fit their specific investment thesis.

The Solution & Results

We deployed a systematic outreach campaign targeting founders and CEOs of smaller, complementary software companies that were not actively for sale. The messaging was positioned as a strategic partnership inquiry, leading to high engagement.

The program generated 137 initial conversations with founders, bypassing the traditional, auction-driven M&A process.

Within 60 days, this activity surfaced $3.2M in actionable, off-market acquisition opportunities that fit the firm's strategic criteria.

This established a repeatable, proprietary deal origination engine for the firm, allowing them to execute their add-on strategy with a pipeline of non-competitive opportunities.

Start The Conversation

Schedule a confidential consultation to discuss your business development objectives and see whether our approach is a fit for your growth targets.

Start The Conversation

Schedule a confidential consultation to discuss your business development objectives and see whether our approach is a fit for your growth targets.

Start The Conversation

Schedule a confidential consultation to discuss your business development objectives and see whether our approach is a fit for your growth targets.