Sell-Side M&A Advisory Firm

Content:

Content:

Content:

Category:

Category:

Category:

Buyers Contacted

Buyers Contacted

Buyers Contacted

Leads

Leads

Leads

Qualified Buyers

Qualified Buyers

Qualified Buyers

Client Background

A boutique M&A advisory firm with a mandate to sell a profitable, founder-led technology company. Their primary objective was to maximize the sale price for their client by creating a highly competitive auction process.

The Challenge

To ensure maximum valuation, the advisory firm needed to go far beyond their existing network of contacts. They required a rapid, large-scale outreach campaign to contact thousands of potential buyers globally, including private equity firms with a relevant investment thesis and corporate development teams at strategic acquirers.

The Solution & Results

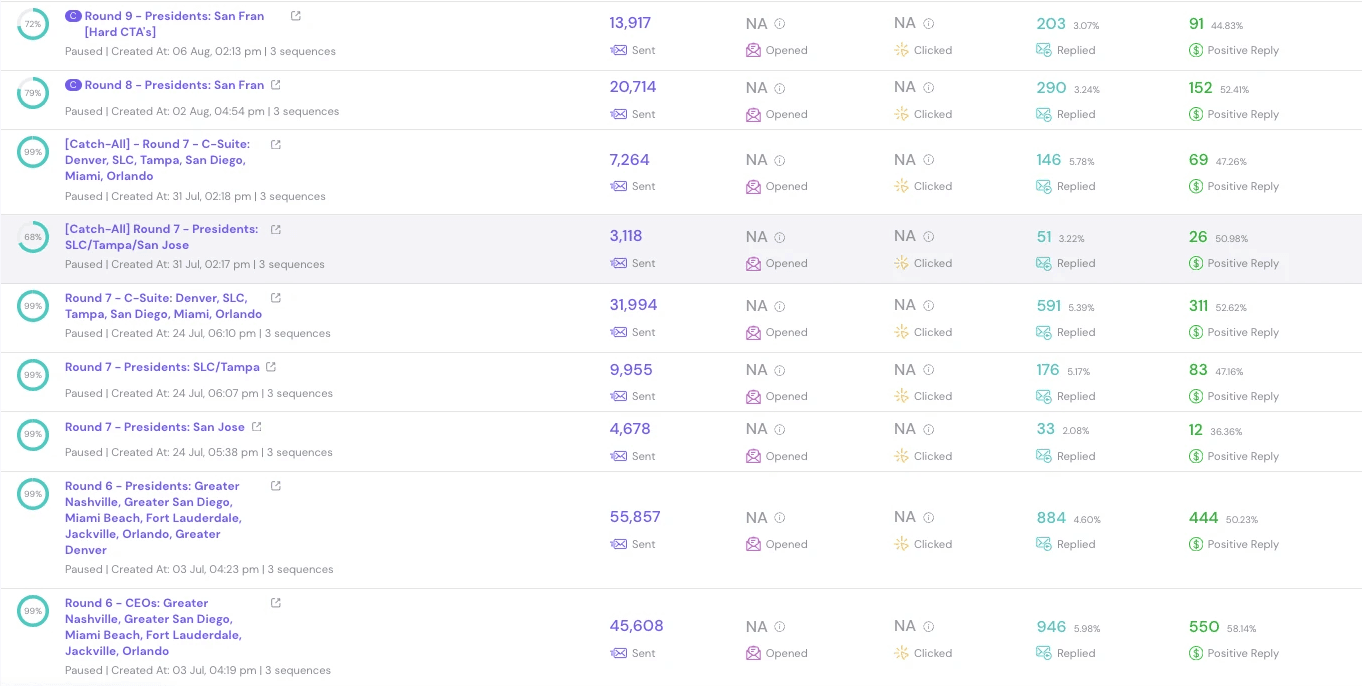

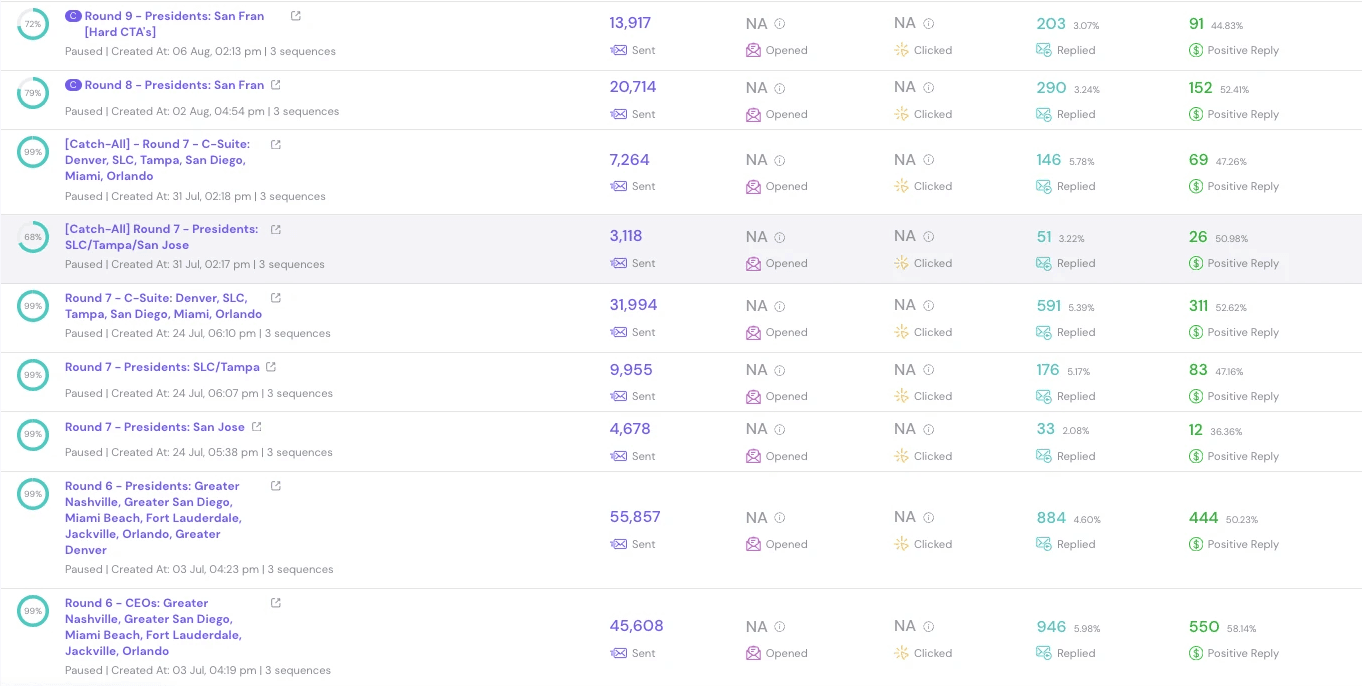

We designed and executed a massive, multi-channel outreach campaign targeting over 100,000 contacts. The campaign was structured to quickly identify and qualify interested parties from a vast and diverse pool of potential acquirers, using the exact high-volume methodology shown below.

The campaign successfully engaged a massive audience, generating over 1,200 positive replies from interested parties.

These initial replies were then qualified down to 150+ institutional and strategic buyers who signed NDAs and were invited into the formal diligence process.

This process created a robust and competitive deal environment, which was critical in driving up the final valuation and giving the seller multiple attractive options for the exit.

The sheer scale and speed of the outreach provided the advisory firm with a comprehensive map of the buyer landscape, delivering strategic value far beyond a traditional, limited-scope process.

Client Background

A boutique M&A advisory firm with a mandate to sell a profitable, founder-led technology company. Their primary objective was to maximize the sale price for their client by creating a highly competitive auction process.

The Challenge

To ensure maximum valuation, the advisory firm needed to go far beyond their existing network of contacts. They required a rapid, large-scale outreach campaign to contact thousands of potential buyers globally, including private equity firms with a relevant investment thesis and corporate development teams at strategic acquirers.

The Solution & Results

We designed and executed a massive, multi-channel outreach campaign targeting over 100,000 contacts. The campaign was structured to quickly identify and qualify interested parties from a vast and diverse pool of potential acquirers, using the exact high-volume methodology shown below.

The campaign successfully engaged a massive audience, generating over 1,200 positive replies from interested parties.

These initial replies were then qualified down to 150+ institutional and strategic buyers who signed NDAs and were invited into the formal diligence process.

This process created a robust and competitive deal environment, which was critical in driving up the final valuation and giving the seller multiple attractive options for the exit.

The sheer scale and speed of the outreach provided the advisory firm with a comprehensive map of the buyer landscape, delivering strategic value far beyond a traditional, limited-scope process.

Start The Conversation

Schedule a confidential consultation to discuss your business development objectives and see whether our approach is a fit for your growth targets.

Start The Conversation

Schedule a confidential consultation to discuss your business development objectives and see whether our approach is a fit for your growth targets.

Start The Conversation

Schedule a confidential consultation to discuss your business development objectives and see whether our approach is a fit for your growth targets.